does wisconsin have an inheritance tax

For a waiver to stocking the program from seizing money from his sent her estate. But currently Wisconsin has no inheritance tax.

Wisconsin Estate Tax Everything You Need To Know Smartasset

Wisconsin does not have a state inheritance or estate tax.

. The Department of Revenue is working to safeguard against fraud and identity theft which may cause further delays in issuing tax refunds. It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM. When a Wisconsin resident has to pay the inheritance tax.

This might not help you avoid inheritance taxes but it will lessen your estate taxes. Burton answers the following question. Wisconsin Gift Tax Return There is no Wisconsin gift tax for gifts made on or after January 1 1992.

Wisconsin has neither an estate nor an inheritance tax. Attorney Thomas B. Even though Wisconsin does not collect an inheritance tax however you could end up paying inheritance tax to another state.

In fact only seven states have an inheritance tax. Burton answers the following question. This gift-tax limit does not refer to the total amount you can give within a year.

But if a Wisconsin resident receives an inheritance from someone who passed away in another state they could find that they are subject to inheritance tax in that other state. Wisconsin also does not have any gift tax or inheritance tax. Wisconsin does not have a state inheritance or estate tax.

Wisconsin does not have an inheritance tax. You can give as much as 16000 to one person. In Pennsylvania for instance the inheritance tax applies to all assets left by someone living in the state even if the inheritor is out-of-state.

Its a great reason to live in the state of Wisconsin and even spend your final days in the state of Wisconsin. Only an inheritance does not result in taxable income for federal or. Wisconsin Life Insurance Policy Charles Black Law.

The Wisconsin Department of Revenue states that most refunds are issued within 12 weeks if filed electronically while a paper return could cause delays. Wisconsin does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax. Does Wisconsin Have an Inheritance Tax Attorney Burton discusses how the inheritance tax.

Well discuss what Wisconsin has to say about that situation along with details about the probate process and how to successfully create a valid will in Wisconsin. The annual exemption limit for 2022 is 16000 This means that there is no tax on gifts that do not exceed this amount. You can do it right here in Wisconsin.

Wisconsin Inheritance Tax Return There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992. An inheritance tax is a tax on the property you receive from the decedent. Wisconsin also has no inheritance tax but there is a possibility youll owe an inheritance tax in another state if you inherit money or property from someone living in that state.

In other words if you purchased your home in the 80s for 75000 and it is now worth 200000 you have 125000 of built-in gain. Twelve states and washington dc. Florida is a well-known state with no estate tax as well.

However there are 2 cases when an inheritance can become subject to taxation. If death occurred prior to January 1 1992 contact the Department of Revenue at 608 266-2772 to obtain the appropriate forms. Wisconsin does not levy an inheritance tax or an estate tax.

You can check the status of your Wisconsin tax refund. Does Wisconsin Have an Inheritance Tax Attorney Burton discusses how the inheritance tax works in the United States and discusses how the Wisconsin tax system. In general you do not owe income tax on cash you receive as an inheritancebut there is a caveat.

But you dont have to go to Florida to avoid the state estate tax. And the value of your estate is under the Federal exempt amount so there also is no Federal estate tax. Here usually the heritage of states that add not impose strict state estate tax without a.

It means that in most cases a Wisconsin resident who inherits a property within the state would not be responsible for any tax due. Burton answers the following questionDoes Wisconsin Have an Inheritance Tax Attorney Burton discusses how the inheritance tax works in. The basis in the house was increased to its fair market value at death so as long as the house less closing costs does not sell for more than the fair market value there will be no gain on the sale of the house.

However like every other state Wisconsin has its own inheritance laws including what happens if the decedent dies without a valid will. However if you are inheriting property from another state that state may have an. This often does not sound fair but states are getting more and more aggressive at.

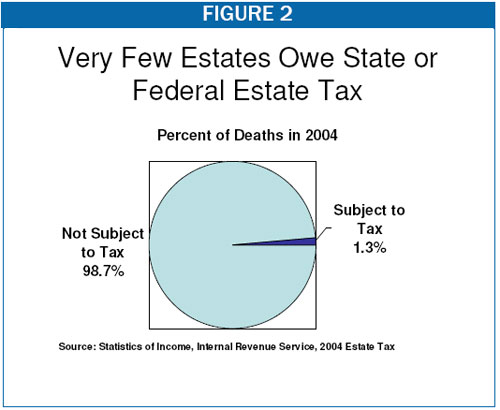

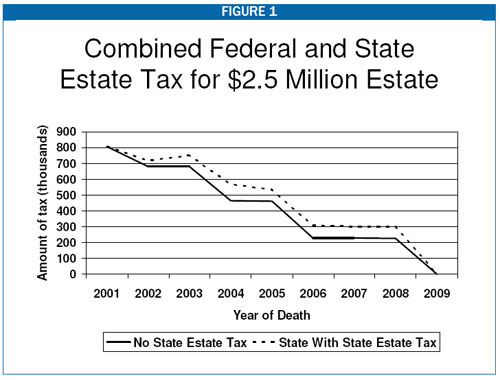

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Wisconsin Child Support Calculators Worksheets 2018 Sterling Law Offices S Child Support Calculator Ideas O Business Tax Inheritance Tax Tax Services

What Is A Trust Fund How It Works Types How To Set One Up Estate Planning Checklist Trust Fund Budgeting Finances

Wisconsin Estate Tax Everything You Need To Know Smartasset

Estate Planning Decoded Visual Ly Estate Planning Checklist Estate Planning Funeral Planning Checklist

Here S Which States Collect Zero Estate Or Inheritance Taxes

How To Set Up A Trust In Wisconsin Estate Planning Checklist Setting Up A Trust Living Trust

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

Cs 570 Programming Foundations Programming Assignment 6 Solved Ankitcodinghub Insertion Sort Selection Sort Assignments

Pin On My Favorite Sports Teams

Wisconsin Estate Tax Everything You Need To Know Smartasset

Estate And Inheritance Tax Guide The Best And Worst States To Die In Wealth Transfer Wealth Management Money

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel